F4B NARRATIVE

Why finance for biodiversity?

Biodiversity is critical to economies. Some 50% of global GDP directly depends on nature. Financing drives economies, shaping how we produce and consume, and how we impact on the planet, through investment in major systems such as food, transport, energy and land-use. Capital is systematically misallocated because financial decision-making fails to account for nature-related financial risks. Financing for biodiversity means changing the financial decisions that drive biodiversity loss and investing in restoration.

Biodiversity impacts and dependencies are currently not measured, managed or priced , and are not taken into account in financing decisions. As a result our global economy is consuming and destroying the biodiversity that we depend upon for our survival.

There is a growing recognition of the importance of the nexus between finance and biodiversity, with new analyses and initiatives emerging. Biodiversity is still overshadowed by climate change. But momentum is growing. Some initiatives are focused on individual public financing mechanisms, some on the cost of inaction, and some on particular aspects of biodiversity, such as oceans, forests and food systems.

There is the potential for ambitious action, but also the risk of confusion, distraction and under-delivery, and barriers of complexity and fragmentation need to be overcome.

The Finance for Biodiversity Initiative

Finance for Biodiversity (F4B) was set up in October 2019 as an initiative to catalyse systemic action to increase the materiality of biodiversity in financial decision-making. It was established by the MAVA Foundation.

It operates as a dual purpose platform, both with its own research and implementation capability, as well as a programme for regranting resources to others. It is supported by the MAVA Foundation with Vivid Economics leading on analytics, and its work is guided by a leadership group of experts and practitioners in the field.

Our theory of change

Materiality drives financial decision making: shifting financial decision making depends not only on demonstrating the materiality of biodiversity in financing decisions but creating it:

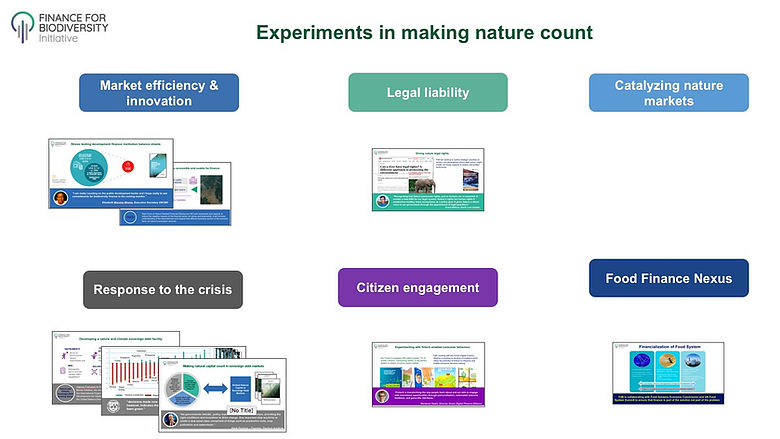

Measurement can make a major contribution to making financial markets work. Metrics and standards make the benefits and liabilities of biodiversity more meaningful in the minds of decision makers >> Our workstream on market efficiency and innovation

People and institutions determine what counts; changing incentives so that the risks and value of nature affect the bottom line. This can be through:

-

Citizens acting as consumers, individually and collectively >> Our workstream on citizen mobilization

-

Policies that penalise or incentivise those that impact biodiversity >> Our workstream on policy and rules

-

Legal mechanisms for creating financial consequences for damage. >> Our workstream on legal liability

Crisis provides a critical juncture for change to redesign key aspects of the financial system, to create and amplify feedback signals that increase the value of biodiversity in private and public financing decisions. >> Our workstream on response to crisis

How we work

F4B’s approach is to develop and test ideas through collaboration, leveraging of existing initiatives, and catalysing new areas of work. We work through:

-

Idea generation, responding rapidly to global developments as they unfold

-

Convening experts, influencers and organisations to explore opportunities

-

Commissioning & partnering to develop analysis and solutions

-

Research to create compelling, evidence based cases for action

-

Making deals happen through engagement with public and private partners

A Framework for Systemic Change

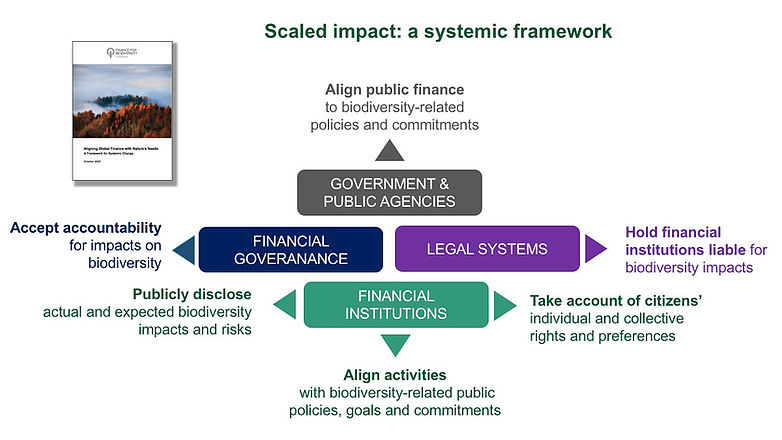

Finance for Biodiversity has distilled the insights, experience and expertise of many working at the nexus of finance and biodiversity into a framework for action in aligning finance and biodiversity.

The framework is made up of six core elements, along with specific recommendations that we believe exemplify how to ambitiously advance each element in practice:

-

Align Public Finance with Biodiversity: governments and public agencies should transparently align all public finance to biodiversity-related policies, goals and commitments.

-

Create Liability for Biodiversity: legal systems should make financial institutions liable for biodiversity impacts.

-

Advance Citizens’ Biodiversity Choices: financial institutions should take account of citizens’ individual and collective biodiversity-related rights and preferences in their financing decisions

-

Align Private Finance with Public Policy: financial institutions should ensure that their activities are consistent with biodiversity-related public policies, goals and commitments.

-

Disclose Impacts on Biodiversity: financial institutions should publicly disclose actual and expected biodiversity impacts and associated risks.

-

Integrate Biodiversity into Financial Governance: institutions governing global finance should ensure that financial institutions effectively steward biodiversity.

>> Read our second white paper